Get paid faster and put more money in your pocket

Higher sales, fewer headaches

Never miss a sale

Get the best credit card processing solution for small businesses. The way your customers shop and pay keeps changing — give them the flexibility, security and convenience they crave.

Payment processing

Accept all the ways customers want to pay with a consistent, convenient checkout experience that keeps them coming back.

Billing and invoicing

Go paperless and get paid faster thanks to automated billing and invoicing that helps save time and reduce errors.

Capital lending

Get fast and hassle-free capital that connects business owners to the best loan types and terms with expert funding advisors.

Flexible, contactless payments

Credit card processing, ACH payment processing and more: Take all popular payment types on premise, on the road or online.

Quick checkouts and outage protection

Count on minimal downtime, speedy card processing services and offline processing.

Transparent pricing and fees

No forms, guesswork or hidden fees — just a transparent merchant services partner you can trust.

Security and fraud protection

Stress less with tokenization, end-to-end encryption and EMV-enabled hardware.

Accept ACH payments instantly

Boost customer loyalty and get paid faster by accepting popular payment types in a flash.

Always-on customer support

Enjoy 24/7 customer service from expert US-based support reps.

No set up, service, or software fees*

©2023 Heartland, a Global Payments company (NYSE: GPN). All rights reserved.

Heartland is a registered ISO of The Bancorp Bank, Philadelphia, PA.

Heartland Payroll Solutions, Inc. NMLS# 1799654

Accept all the ways your

customers want to pay

Getting paid has never been easier. Enjoy fast, flexible processing for the broadest range of payment types, so you can boost sales, satisfy customers and save time.

- Credit card payments

- Debit card payments

- Gift cards

- Digital wallets

- Mobile payments

- QR codes

- ACH

- Checks and eChecks

- Online payments

What is payment processing?

Payment processing is a technology businesses use to accept electronic payments from customers. It’s essentially a series of steps that take place behind the scenes when a customer electronically authorizes funds to be transferred from their account to the seller’s account.

What is the purpose of payment processing?

The purpose of payment processing is to move transaction data through the stages of the card authorization network. This transaction process makes paying and getting paid via non-cash payment methods possible.

What are the steps involved in payment processing?

After a customer makes a purchase via credit/debit card, the payment processor sends an authorization request to the acquirer. The acquirer then routes the transaction request through the issuing bank for approval.

From there, the issuer verifies the transaction is valid, whether the cardholder account has sufficient funds and if the merchant’s account is in good standing. If the transaction is denied, the purchase ends here. If the transaction is approved, the merchant receives authorization and the issuer places a hold for the appropriate amount on the customer’s account.

The acquirer collects the funds from the issuer and deposits them in the merchant’s bank account. The acquirer bills the merchant for all interchange fees and related transaction fees or processing fees. Finally, the cardholder pays the issuer for the purchase, including any interest and fees.

What happens in payment processing?

While payment processing touches many parts of the payments ecosystem, three key things happen: 1) The payment gets authorized. 2) The card issuer verifies or authenticates the payment is valid and not fraudulent. 3) The funds get transferred to the acquiring bank in the settlement process and finally get put in the merchant’s bank account.

Why should I accept credit cards at my business?

There’s no doubt about it: If you’re not accepting card payments, you’re missing out on sales. By accepting credit cards, you open your business up to bigger benefits, including increasing sales, delivering the convenience customers crave, expanding your market, improving cash flow and staying competitive.

What is Payment Card Industry Data Security Standard (PCI DSS) compliance?

PCI DSS compliance is the set of security standards all businesses that accept debit card payments or credit card payments must abide by in order to safeguard cardholder data. These standards are set by the Payment Card Industry Security Standards Council (PCI SSC), which is comprised of card networks, including Visa, Mastercard, American Express, Discover and JCB International. If you don’t comply, you could be financially liable for the consequences of a data breach and potentially be banned from accepting card payments.

Hear what entrepreneurs are saying about Heartland

You’ll be in good company

“Heartland has been so transparent, and it makes for a smooth and open and honest relationship, and we feel like it’s something that we can trust.”

Denise Tran, Bun Mee

“As a business owner, every week is different. The relationship with Heartland has always been very immediate when we need answers to questions. The most valuable part of that was how quickly they got us up and running.”

Jeff Jacobs, Carrol’s Creek

Rusty White, Wrong Iron

“Heartland is a great partner to have for the business that I have now, but also for the ones I want to start in the future. It’s very comforting to know that I can take them along with me.”

How do I choose a payment processor?

No matter what provider you choose, you deserve to be treated with fairness, transparency and respect. That’s why we created the Merchant Bill of Rights — to help you tell the difference between a provider that has your best interests at heart and one that’s hiding behind smoke and mirrors.

Onsite

Let in-person buyers tap, dip or swipe their favorite payment method. Mobile phone, tablet, laptop, terminal or POS system — select a new payment device of your choice or integrate our software with your existing hardware solution.

Online

Whether via website or app, make the sale — even when your customers are on the couch. With an online payment solution that’s optimized for mobile and works with popular ecommerce platforms, you’ll capture sales beyond your brick and mortar and after hours.

On the go

Curbside, tableside or poolside, deliver next-level convenience by bringing checkout directly to your customers when they’re ready to go. You’ll have everything you need to accept payments in a snap with on-the-go processing.

Take payments whenever, wherever

- Create digital invoices on demand, including one-time payments, recurring payments and estimates

- Use our online invoicing dashboard to effortlessly keep track of the status of every invoice

- Build a library of billable line items, product or service bundles and discounts

- Sync transaction data with QuickBooks® Online using our easy integration

- Automate your accounts receivable process and reduce errors

- Leverage our cloud-based Accounting Sync add-on — no additional software or hardware needed

Breeze through invoicing

Stay synced without the stress

Let Payments Manager+ do the heavy lifting

Process with peace of mind

- Save on interchange fees with Level 2 and 3 processing

- Get more detailed transaction data, including customer code and tax amount to help verify authenticity

- Include line-item details, like product codes, quantities and unit prices for large B2B transactions

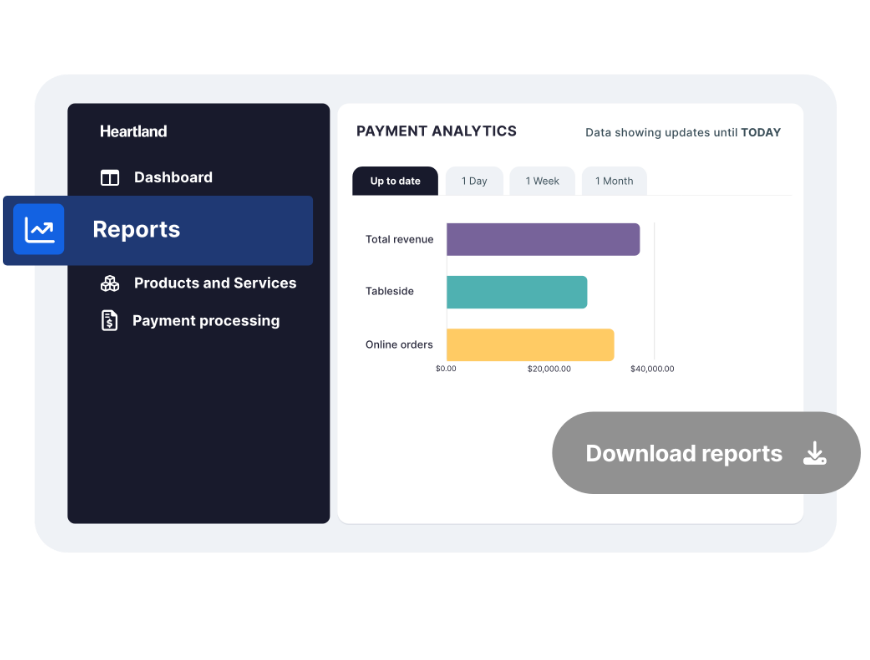

Gain insights into your business

- Report on payments by method, card brand, transaction source or approval status

- Filter any report by date range for a zoomed-in view — 24/7, on any device

- See customer name and ID, transaction date, payment amount and approval response on every report

Free your money

- Get paid on your schedule with instant, same-day and next-day funding*

- Benefit from lightning-fast transfers and flexible deposit options

- Enjoy 365 funding, even on holidays and weekends

*Merchants on certain processing programs are not eligible for next-day funding; funding may be delayed by Heartland Credit or Risk departments at any time. Not all merchants or transactions will qualify for flat-rate pricing; additional fees may apply. Increases in assessments by card associations may apply.

*All trademarks contained herein are the sole and exclusive property of their respective owners.

*Eligibility and certain restrictions may apply. Offer valid until 12/31/2024 for new Payments Manager+ customers only. Sales quote applies for 15 days upon receipt. Merchant must process payments through Heartland. All accounts subject to credit approval. Card processing fees apply.

Get started now with no set-up, service, or software fees

Get paid faster: invoices cleared in minutes, not days

Unlock steady cash flow: set up recurring payments as a pathway to predictable, ongoing revenue

Streamline your business: do less and accomplish more with invoicing automation

Payments Manager+

Faster invoicing, faster payments

Take payments anytime, anywhere

We know that as an owner, you deal with all manner of surprises and complexities. That’s why we’re here to support you 24/7. Trusted by over 4.5 million merchants and more than 1,500 financial institutions worldwide: wherever you are, we’re there to help.

In person

Curbside, in shop or on the go, take credit card payments wherever your business takes you. With flexible devices and contactless payment options, Heartland makes it easy for customers to pay and be on their way in seconds.

Online

Accept credit card payments online from your website or app without the hassle. Whether your customers are ordering takeout, their new favorite shoes or paying for the auto repair service you provided last week, our scalable online payment solution is designed to do it all.

Tap to pay

No need to insert or swipe credit and debit cards — customers can make touch-free payments with a single tap to your point of sale or card reader.

Digital wallet

Patrons wanting to pay with their digital wallets? Whether they use Google Pay™ or Apple Pay®, mobile phone or smart watch, we got you.

Pay by link

Generate an invoice and send a secure pay by link via text, QR code or email straight to your customers’ phones.

Contactless payment options

customers will love

Let Payment Manager+ do the heavy lifting

Breeze through invoicing

- Create digital invoices on demand, including one-time payments, recurring payments and estimates

- Use our online invoicing dashboard to effortlessly keep track of the status of every invoice

- Build a library of billable line items, product or service bundles and discounts

Stay synced without the stress

- Sync transaction data with QuickBooks® Online using our easy integration

- Automate your accounts receivable process and reduce errors

- Leverage our cloud-based Accounting Sync add-on — no additional software or hardware needed

Process with peace of mind

- Save on interchange fees with Level 2 and 3 processing

- Get more detailed transaction data, including customer code and tax amount to help verify authenticity

- Include line-item details, like product codes, quantities and unit prices for large B2B transactions

Gain insights into your business

- Report on payments by method, card brand, transaction source or approval status

- Filter any report by date range for a zoomed-in view — 24/7, on any device

- See customer name and ID, transaction date, payment amount and approval response on every report

Free your money

- Get paid on your schedule with instant, same-day and next-day funding*

- Benefit from lightning-fast transfers and flexible deposit options

- Enjoy 365 funding, even on holidays and weekends

Invoices

Wave goodbye to the days of manual data entry and snail mail slowing you down. Use customizable invoice templates to create professional invoices in a few clicks. When you’re ready, send invoices or pay by links via text, QR code or email in seconds.

Estimates

Still working out the details with your customer? Go from estimate to invoice without a hitch. Easily build estimates breaking down total costs of your job, product or service and seamlessly convert them into invoices when the time is right.

Reconciliation

You don’t need to hire an office manager to reconcile the books. Rest easy knowing invoices and payments will sync with your QuickBooks® Online accounting software — no matter when or where the payment happens.

Faster payments. Better cash flow.

Stay on brand

Never stress about your invoicing not matching your business’ brand again. Personalize your invoices and hosted payments pages with your business name, logo and brand colors.

Accept popular payment types

Deliver the convenience your customers crave and let them use their preferred payment method: credit card, debit card, ACH bank transfers, cash, Google Pay® or Apple Pay®.

Schedule recurring invoices

Offering paid plans or anticipating repeat payments? Schedule invoices for recurring services including memberships, ongoing projects and weekly, monthly or quarterly subscriptions.

Invoice and get paid your way

Support around the clock

Get access to 24/7/365 knowledgeable customer support from our US based support team. Whenever you have a question, our experts are ready to help.

Security and fraud protection

Process with peace of mind knowing end-to-end encryption, tokenization and secure EMV technology are working together to protect card data and prevent fraud.

PCI compliance assistance

Rest easy knowing you don’t have to navigate compliance on your own and your business is equipped with PCI-validated devices, so you can keep processing without a hitch.

Chargeback management

We deliver dispute and exception management tools to help you minimize losses from chargebacks. That means you’ll safeguard your business and save time and money.

Stress-free surcharging

Offset your credit card processing costs with our compliant surcharge program that enables you to apply a fee at checkout. Reduced card costs enable you to apply those savings toward growing your business.

Offline payments

Keep cashing in even when the power goes out. Our offline payments capabilities ensure uninterrupted sales during a power failure or other network disruption.

Enhanced reporting

You don’t have to operate in the dark — make better decisions with the right data. Get reporting and analytics on transaction sales history, payment history and batching reports.

Frictionless integration

With simple APIs, a software development toolkit and dedicated support, our payment processing solutions ensure easy setup, and smooth sailing for developers too.

More than payment processing

More than

payment processing

Don't just take our word for it

Denise Tran

Bun Mee

“Heartland has been so transparent, and it makes for a smooth and open and honest relationship, and we feel like it’s something that we can trust.”

Rusty White

Wrong Iron

“Heartland is a great partner to have for the business that I have now, but also for the ones I want to start in the future. It’s very comforting to know that I can take them along with me.”

Jeff Jacobs

Carrol’s Creek

“As a business owner, every week is different. The relationship with Heartland has always been very immediate when we need answers to questions. The most valuable part of that was how quickly they got us up and running.””

You'll be in good company

From big retail chains to family owned restaurants, companies all over the US trust us with their payments. Not all payment processors are equal.

Payment processing FAQs

Get ahead and stay ahead with Heartland Payments+