- Your industry category – make sure that you’re not considered a “high risk merchant”

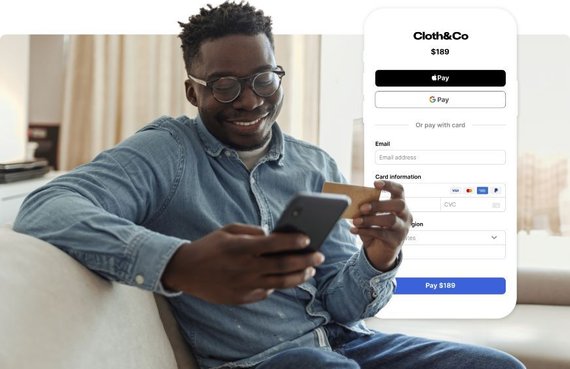

- Whether you plan to sell via in-person transactions, online or both

- Number of locations

- How you accept transactions: on a terminal or card reader, or through your website or your own software

- Types of payments you’d like to accept: credit cards, ach, google pay™, apple pay®, gift cards, ebt, etc.

- How quickly you would like to receive your funds

- Estimated annual volume – it’s ok if you’re not sure if you’ll be a low-volume or high-volume business, just a ballpark estimation is needed

- Estimation of card present, in-person transactions

- Estimation of card not present transactions made over the phone or through your online store